Curious about what keeps experts, CEOs and other decision-makers in the Intelligent Document Processing (IDP) space on their toes? Get food for thought on IDP-related topics from the industry’s leading minds.

In this opinion piece, Petra Beck, Senior Industry Analyst at analyst firm Infosource, explains how Intelligent Document Processing is becoming a strategic enabler for intelligent automation and how she interprets – from an analyst’s perspective – this changing landscape.

The case for automation is more compelling than ever. Faced with rising labor costs, persistent skill shortages, and mounting pressure to improve efficiency and agility, organizations across industries are accelerating their digital transformation agendas. At the heart of this transformation lies the need to automate information-intensive processes—those that rely heavily on unstructured content such as documents, emails, and forms. These processes are not only ubiquitous but also critical to business operations, from onboarding and claims processing to compliance and customer service.

Historically, Intelligent Document Processing (IDP) has played a foundational role in this landscape—digitizing paper, extracting data from semi-structured and unstructured documents, and feeding downstream systems. While these capabilities remain essential, they no longer define the frontier. IDP is evolving into a strategic enabler of intelligent automation. It is becoming the cognitive engine that allows enterprises to interpret and act on unstructured information at scale.

GenAI: A Defining Force at Two Levels of Automation

The most transformative force accelerating this evolution is Generative AI (GenAI). Its impact is being felt at two distinct but interconnected levels: within IDP itself, and across the broader enterprise automation stack.

At the IDP level, GenAI is helping overcome long-standing limitations. Handwriting recognition—especially for cursive and unconstrained styles—has seen significant improvements. The dependence on supervised learning that requires large training sets is diminishing, thanks to few-shot and zero-shot learning capabilities. Beyond structured extraction, GenAI brings contextual understanding, enabling classification and data extraction even in ambiguous or unstructured scenarios. These advances are expanding the scope of IDP, allowing it to support more complex, variable, and multilingual document types with greater accuracy, adaptability, and significantly reduced need for manual intervention.

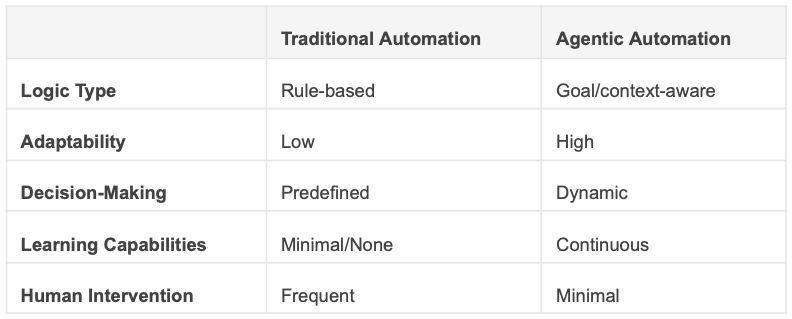

At the enterprise process automation level, GenAI is enabling a shift from deterministic, rule-based automation to agentic systems—autonomous, goal-driven agents that can plan, decide, and act across complex workflows. These agents are not just executing tasks; they are orchestrating processes, collaborating with other agents, and adapting to changing business contexts in real time. In this new paradigm, IDP evolves from a pre-processing utility into a dynamic sensory and interpretive layer—enabling agents to perceive, understand, and respond to the unstructured information that drives enterprise decision-making.

From Hype to Maturity: The IDP Market in Transition

As with any transformative shift, the path continues to be uneven. The initial wave of enthusiasm around GenAI-infused IDP solutions after the initial versions appeared in the market 2 years ago, gave way to a more cautious phase. Early pilots often fell short of inflated expectations. While GenAI models rapidly improved, vendors were still refining their offerings, and enterprises enhanced their skill set. This phase of disillusionment, however, is not a setback. It is a necessary step in the market’s maturation.

Today, many of the factors that once inhibited adoption are becoming drivers. The accuracy of GenAI models has improved significantly, thanks to the rise of domain-specific language models and retrieval-augmented generation (RAG) systems. The cost of deployment is decreasing, while the ROI is becoming more tangible. Regulatory uncertainty is giving way to clearer frameworks, particularly in the EU. And perhaps most importantly, the skill base—both among vendors and enterprise users—is expanding.

Still, the digital divide is increasing, both among users as well as vendors. Vendors with AI-native platforms and deep expertise in GenAI are pulling ahead, offering differentiated capabilities and attracting investor attention. Others, still reliant on legacy architectures, are struggling to keep pace. This divergence is likely to widen as agentic automation becomes more mainstream.

Infosource’s Framework for Navigating IDP Transformation

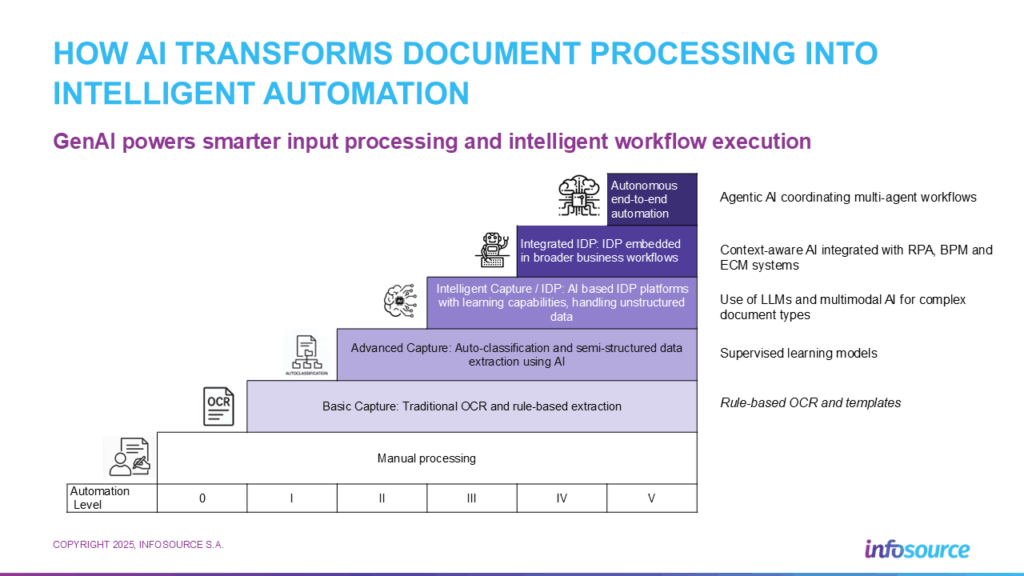

To make sense of this evolving landscape, we at Infosource continue to refine our maturity model that reflects the progression of IDP capabilities—from basic capture to autonomous systems. This model is not just a taxonomy; it is a roadmap for understanding where the market is today, and where it is headed.

- Basic Capture – Traditional OCR and rule-based extraction. Effective for structured documents but limited in flexibility.

- Advanced Capture – AI-driven classification and semi-structured data extraction. More adaptable, but still requires significant configuration.

- Intelligent Capture – AI-first platforms capable of learning from data, handling unstructured inputs, and improving over time.

- Integrated IDP – IDP embedded in broader business workflows (e.g., RPA, BPM, ECM). No longer a siloed function, but a strategic enabler.

- Autonomous IDP – Agentic, self-learning systems that adapt and optimize workflows in real time, collaborating with other agents and requiring minimal human intervention.

What makes this model particularly relevant now is that we are seeing movement across all levels. Some organizations are still modernizing from basic to advanced capture. Others are experimenting with intelligent and integrated IDP. And a few pioneers are pursuing end-to-end process automation. The maturity model provides a lens through which to assess not just vendor capabilities, but also enterprise readiness and market dynamics.

It also helps explain the current volatility in the market. As GenAI capabilities accelerate, the gap between leaders and laggards is widening. Vendors with deep learning expertise, multi-modal capabilities, and agent orchestration frameworks are pulling ahead. Those without are falling behind. Similarly, enterprises with internal AI talent are progressing rapidly, while those without are struggling to scale.

Looking Ahead: From Tactical Tool to Strategic Infrastructure

This divergence is not just technical—it is strategic. The ability to move up the maturity curve will increasingly define competitive advantage. In the core IDP market, the drivers are now clearly outweighing the inhibitors. GenAI-infused solutions have moved beyond experimentation, with many organizations already realizing tangible benefits in accuracy, scalability, and speed. The market is entering a phase of accelerated adoption and platform consolidation.

Meanwhile, the frontier of innovation has shifted to agentic automation. Here, we are seeing a new wave of experimentation—focused on orchestrating autonomous workflows through intelligent agents. While the promise is significant, the maturity of these solutions is still emerging, and we expect meaningful business impact to materialize in the mid-term.

The journey will not be uniform. Different industries, regions, and organizations will move at different speeds. But the direction is clear: IDP is evolving from a tool for document extraction into a foundational capability for intelligent automation. We will explore these dynamics in greater depth in our upcoming State of the IDP Industry report, which will forecast key shifts in use cases, verticals, input types, and business models shaped by the macro and micro trends outlined.

The journey will vary by industry, region, and organization—but the trajectory is clear: IDP is evolving from a tactical tool into strategic infrastructure for intelligent automation. Our upcoming State of the IDP Industry report will explore these dynamics in depth, analyzing and forecasting key shifts in use cases, verticals, input types, and business models.

About the author:

Petra Beck is a Senior Industry Analyst at Infosource, where she leads market analysis and forecasting for Intelligent Document Processing (IDP). She brings over 25 years of experience in Information Management, combining international perspective with deep expertise in research and strategic planning.

To find more news from Infosource, click here.

📨Get IDP industry news, distilled into 5 minutes or less, once a week. Delivered straight to your inbox ↓